Flexible Technology Can Quickly Transform The Client/Member Experience.

December 21, 2023

Integrate UC and CC

December 21, 2023Talk to Unlock

It is a given that for Financial Services Institutions (FI) and Credit Unions (CU), the client/member experience drives everything that they do. New approaches on how to better serve clients/members and how to make the end-to-end financial process less problematic should always be part of their modernization plans. Accelerating Identity Verification for FI and CU organizations is now imperative.

In today’s highly mobile society, people are very comfortable using digital technologies of all types – regardless of how their personal information is being used. The only overriding expectation is that whatever they are doing should be quick, painless yet secure. With these new realities in mind, clients/members are now questioning the need for traditional and time-consuming agent-centric authentication processes such as passwords, PINs, and other knowledge-based factors. Those approaches require too many process steps, take up too much time, and use personal information that is increasingly easy to find online, therefore increasing the probability of misuse or fraudulent misrepresentation.

Technology-based approaches can improve these processes and by combining various capabilities, can go beyond the traditional security processes to offer quicker and more secure authentication.

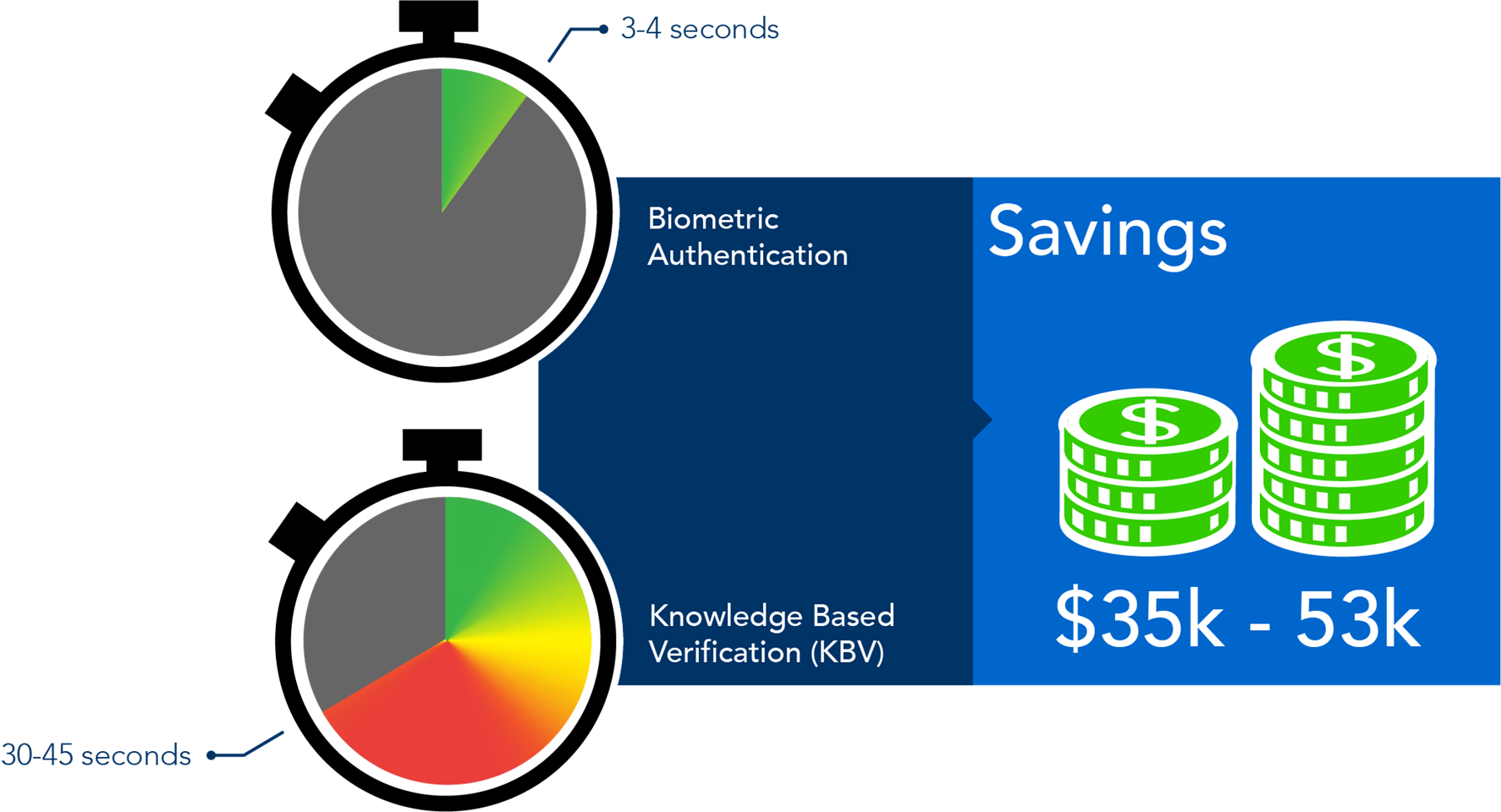

At the same time, FI/CU organizations need solutions that reduce per-call handling times and provide ‘guaranteed’ accuracy throughout the whole process.

As authentication is usually the first step in an FI/CU call flow, it should be undertaken as an integral component of the inbound call handling stream, whether a live agent or automated call (handled by a chatbot) without causing any undue time delays.

Biometric authentication leverages a wide range of advanced technologies that recognize and verify a person’s identity through their specific physical or behavioral characteristics. With today’s increasing use of different inobtrusive biometric capabilities, including facial recognition [ Narita Airport in Japan is covered with more than 500 HD cameras], fingerprint readers on laptops and mobile devices, and voice commands [Alexa, Siri, Cortana, et al] there is no longer much push-back from users about using these capabilities.

The advantages are obvious:

– clients/members do not have to do or remember anything to be authenticated, and

– voice authentication only requires a person to speak to be verified.

The caller’s identity is checked and confirmed in real-time during the call. Voice Authentication solutions will typically analyze unique voice characteristics while the client/member is on the call and compare various conversational elements against the self-identified individual’s stored voiceprint. The most advanced applications can do so regardless of language or accent and are also capable of ‘learning’ more each time a caller is authenticated. If the caller’s identity cannot be confirmed, then the call can be routed to another agent or the security group for exception-based treatment.

Looking more broadly at process improvement, the integration of voice biometrics with a CTI application can trigger the agent (either live or virtual) that the member’s identity has been authenticated and then can provide access to all the other financial services to which they are authorized to access. Afterward, all relevant call information can be forwarded to the Customer Relationship Management (CRM) solution to update that client/member’s file with their specific interactions or requests.

It’s not Speech Recognition

While voices can be impersonated, voice biometrics has improved so that the authentication process cannot be circumvented because it analyzes voice characteristics that are indistinguishable from the human ear.

Biometric authentication technology makes it possible to verify the caller’s identity by analyzing their voice and speech characteristics (pronunciation, inflection, accent, tone, word emphasis, dynamic range, etc.) and then comparing those characteristics against the characteristics on file. Speaker verification is based on the fact that every speaker has a unique voiceprint, which can be used as a reliable, secure, and convenient biometric identification tool. Voices are never identical in pattern, rhythm, and speed, therefore one person’s voiceprint is difficult if not next to impossible to accurately mimic or forge. With more advanced biometric authentication solutions, if there is difficulty authenticating the caller, they can be asked more questions and the application can further assess the voice to determine if the person is really who they say they are.

The Importance of Digital Channels

Bank of America recently reported that over 70% of its customer households use their digital platforms, and as a result, 49% of all Bank of America sales are now digital channel-based, a 46% year-over-year increase. [ BoA now completes 1.5 million digital sales transactions annually ].

Be Mindful of Data Privacy and the Requirement for Informed Consent

As with all digital solutions, there is a crucial caveat: biometrics are considered sensitive personal information, which falls under the provisions of various privacy and data protection laws both globally and in the US, where increasingly more states have their own privacy legislation(2). Organizations must ensure that the collection, storage, and processing of voiceprints are compliant with all applicable legislation and that they protect their user’s data. This also requires that the FI/CU ensures that their clients/members provide their ‘informed biometric consent’(3) as part of the first engagement when authentication technologies are implemented and before personal data is collected.

The FI/CU must also ensure that it stores all this data so that the individual’s Personal Identifiable Information (PII) is disassociated from the voiceprint, for example, the client/member voiceprint is correlated to a binary string ( 0’s and 1’s ) that has no meaning to anyone looking at it.

Consider Biometric Authentication for these additional client/member services

Accessibility: Provide uniform access across all FI/CU applications and access points in branches with voice activation.

Safety Deposit Box Access: Clients/Members can use voice authentication to gain access to their safety deposit boxes in their local branch.

Bill Payments: Enable highly secure and advanced voice-based payments.

Customer Support: Once a client/member is enrolled in the voice recognition system, their voiceprint can be accessed across the organization’s support channels, resulting in a seamless client/member experience without the need for re-validation at each departmental hand-off.

As FI/CU organizations evolve to meet the rapidly changing client/member needs, they should also strive to ensure that using voice biometrics is as intuitive, and as accessible as possible. This approach will help ensure they can deliver better service faster and more efficiently while making the experience as smooth as possible for everyone.